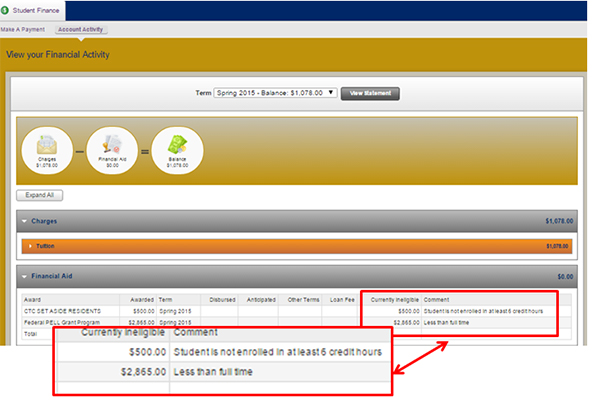

Central Texas College has a program in place to simplify the purchase of textbooks for all students (campus based and online students) receiving financial aid. Financial aid funds will deposit into a student's school account ten days prior to the start date of each class. Tuition and fees will be deducted first. If any funds remain, students may purchase books online or go to the Central Campus bookstore. Remember, the earliest funds may be available to charge books is ten (10) days before the class start date.

Online book charging: If a student wants to charge their books to their financial aid account, they will need to go to the CTC bookstore web page www.ctcbookstore.com. The student will have to choose the payment type of financial aid and supply their student ID number. When checking out a choice will have to be made as to pick up the books or have them shipped. If the student chooses to have them shipped the shipping charges will also be deducted from the available financial aid funds.

Central Campus book charging: Students will need to bring a picture ID and their schedule, pick up their books, then proceed to the checkout counter where they must identify themselves as a financial aid/scholarship student. The bookstore representative will enter the student's identification number and calculate the total charges for books and supplies. The charges will be deducted from the student's account.

Students have approximately 14 days after classes start to charge books. After that time the business office will begin to prepare students' balance checks. Students who choose not to use the CTC Bookstore must purchase books out of pocket and will receive their funds as a balance check once the Business Office starts mailing them.